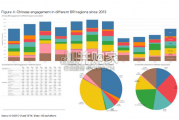

China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

Markets have moved a lot in the past couple of weeks, with the recent 20%+ drawdown in global equities one of the most aggressive on record (see Exhibit 5).Looking across asset classes, the cost-benefit of risk taking is increasingly moving in a positive direction. What kind of weakness can we expect? Well, let's just look at it simply for a moment. Let's assume the US 10 year yield halves from about 100bp to 50bp. That should give us about a 50bp decline in the broad USD (see Exhibit 6). What about risk? Say we get a 10% rally in the S&P 500, which brings us roughly to our equity strategists'year end bear case of 2750. Per Exhibit 7, we should get a 60-70bp decline in the broad USD. These figures are fairly simplistic and the interaction between improving risk and lower rates cannot be simply summed together. Our current environment is somewhatunique: volatility and uncertainty are higher.Finally, falling yields and improving risk driven by central bank stimulus need not behave exactly like 'normal' trading dynamics.

Weview EUR/USD, AUD/USD, and USD/CAD as the mostattractiveexpressions of USD weakness. We need to look beyond historical relationships and dig into policy, which is clearly driving markets rightnow. Compared to aggressive monetary stimulus from the US, we expect fiscal policy to be relatively more important in Australia and Europe in the coming weeks and months, with monetary stimulus unlikely to match the Fed's. As we describe in more detail here, monetary easing tends to be FX-negative while fiscal easing can be FX-positive. The ECB, RBA and BoC are unlikely to match the Fed. Compared to the Fed going to the ZLB and buying at a $75bn/mo pace, we see limited risk of either central bank keeping pace. Indeed the ECB's announced additional QE was only EUR120bn over the remainder of the year - compared to an additional $675bn from the Fed if they start on 1 April. What about the RBA? A cut to 25bp, the ELB, is fully priced,and the probability of QE is admittedly rising. However, we don't think the RBA will really come close to the Fed. We provide more detail on this below (see USD | Time to Go Short), but suffice it to say, if the RBA pursues a yield curve control/caps policy as we expect, this will not likely match the Fed's aggressiveness.

Meanwhile the BoC cut rates to 75bp this week but Governor Poloz emphasized thathis preference is for rates not to go into negative territory. Fiscal policy looks to get more expansionary, though. This is already starting down under. The Australian government announced a package worth A$22.9bn over the coming 2.5 years, or 1.2% of GDP, well in excess of estimates even a few days ago,and the risks of further stimulus in the May budget grow higher by the day. Meanwhile this week the Government of Canada announced considerable fiscal stimulus as well. What about Europe? Fiscal easing so far has been relatively reactive and reluctant. However, we still think the risks of both a) a larger fiscal package and b) a proactive stance in Europe are rising. This is both mechanical and a function of circumstance. European growth had already been under pressure amid the 2019 manufacturing slowdown and longstanding structural/demographic challenges.

标签: 英文报告下载

相关文章

China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

Though the risk of AI leading to catastrophe or human extinction had...

2024-02-26 52 英文报告下载

Focusing on the prospects for 2024, global growth is likely to come i...

2024-02-21 96 英文报告下载

Economic activity declined slightly on average, employment was roughly flat...

2024-02-07 67 英文报告下载

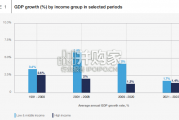

Economic growth can be defned as an increase in the quantity or quali...

2024-02-06 82 英文报告下载

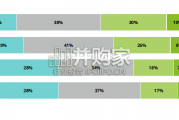

In this initial quarterly survey, 41% of leaders reported their organizatio...

2024-02-05 66 英文报告下载

最新留言