AI provides a breakthrough opportunity to accelerate the design, depl...

2024-05-24 39 英文报告下载

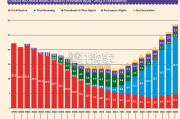

The second biggest life market is Western Europe, with a combined premium pool of EUR775bn in 2023 (global market share: 29.6%). After 2022, when the market shrank by -2.3%, the region returned to positive growth: at +3.3%, it was clearly above the long-term average (CAGR 2013-2023: +2.0%). But not all markets did well in 2023: Heavyweights like Germany (-3.9%) and Italy (-3.9% in the first nine months) continued to shrink, albeit less dramatically than in 2022; the high shares of single premium or unit-linked products still hurt. On the other hand, growth returned to many markets like France, the Netherlands or Sweden. The most astonishing development, however, could be seen in Spain, where the life market powered ahead at +36.3%; it is now the fifth largest market in the region, after the UK, France, Italy and Germany. North America is the third biggest life market (EUR710bn or 27.1%). In 2023, growth moderated considerably, from +9.3% (2022) to an estimated +5.3% – which is still well above the long-term average (CAGR 2013-2023: +2.9%). All other insurance markets (rest of the world, global market share of 4.3%) saw a noticeable acceleration of growth (+9.9% in 2023), mainly driven by Latin America (nearly +20%). The strong growth of the p&c segment (+7.1%) last year was driven by all regions around the globe. North America remained by far the largest market. In 2023, the p&c market stood at an estimated EUR1,168bn (global market share: 54.2%). With a projected plus of +7.1%, the increase in premium income was only a tad slower than in the previous record year (+7.5%). It goes without saying that the North American market is dominated by the US (regional market share: 95.1%).

标签: 英文报告下载

相关文章

AI provides a breakthrough opportunity to accelerate the design, depl...

2024-05-24 39 英文报告下载

Hate and the violence it fuels are on the rise in America. Hate crimes, tar...

2024-05-20 27 英文报告下载

The record executives who have contributed to this report, based all over &...

2024-05-15 27 英文报告下载

The global annual mean near-surface temperature in 2023 was 1.45 ± 0.1...

2024-05-14 17 英文报告下载

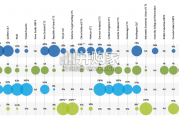

The circles below display information on diferent metric across ETSs in for...

2024-05-13 30 英文报告下载

最新留言