International tourism reached 97% of pre-pandemic levels in Q1 2024, a virt...

2024-07-17 15 英文报告下载

In the US, our equity sector Overweights are focused on the technology and communication services sectors. While we like them for their earnings outlooks and sensitivity to falling bond yields, we also like them for being growth-oriented. This, we believe, fits well with the macro and markets environment we expect for H2 24 as the Fed starts to cut rates to manage a soft landing for the US economy. In Europe, we are Overweight the technology and healthcare sectors. We believe this more barbell-like approach is consistent with the improvement in the growth outlook, while How important are US elections for market? One key event in H2 24 that is firmly on investors’ horizons is the US Presidential election. Since 1972, the S&P500 has, on average, delivered positive returns six months before and after elections, with any volatility limited to the weeks around the election itself. Today, the question is whether the presence of a Fed rate cutting cycle changes this outcome to any degree. Our analysis illustrated in the chart shows that, historically, S&P500 returns were significantly worse than average around elections when the Fed was also cutting rates.

标签: 英文报告下载

相关文章

International tourism reached 97% of pre-pandemic levels in Q1 2024, a virt...

2024-07-17 15 英文报告下载

Potential technologies for the 2024 list were identifed through a sur...

2024-07-11 41 英文报告下载

Global foreign direct investment (FDI in 2023 decreased marginally, by 2 p...

2024-07-08 30 英文报告下载

The report was prepared by a team that included Amat Adarov, Marie Al...

2024-07-01 36 英文报告下载

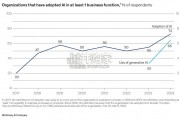

If 2023 was the year the world discovered generative AI (gen AI , 202...

2024-06-24 67 英文报告下载

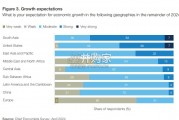

The most notable improvement recorded in the latest survey is in the...

2024-06-13 54 英文报告下载

最新留言