China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

China's property sector has always been heavily regulated by central and local government policies, which were previously used as countercyclical tools to stabilize local level economic performance. During 2005-16, cycles in China's property market occurred roughly once every three years, and resulted in big swings in the valuations of developers. Nevertheless, the housing market has become less volatile since late 2016, with property prices and sales largely moving sideways in 2017-19. The main reason for this was a fundamental shift in the government's policy stance, aiming to maintain housing market stability. The main purpose of housing is purely accommodation, not investment. The change in policy landscape reshapes the risks and returns of the homebuilding industry. Less market risk: Nationwide boom-bust property cycle disappears Since 2017, the central government has delegated more property policy decisions to local governments.

Local governments have the discretion to implement and adjust local level policies, including home purchase restrictions, favorable policies for talent migrants, etc. The policies aim to achieve housing price stability over the medium/long term. As a result, property cycles have become less synchronized across cities. The correlation of property prices across 70 cities fell from 0.81 before 2017 to around 0.4 subsequently. While there are housing cycles at a provincial level, most developers have already expanded geographically or are in the process of regional expansion. This geographical diversification is a key underlying reason for developers' more stable sales performance, and is a factor that rating agencies consider when assigning ratings to the companies.

标签: 英文报告下载

相关文章

China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

Though the risk of AI leading to catastrophe or human extinction had...

2024-02-26 52 英文报告下载

Focusing on the prospects for 2024, global growth is likely to come i...

2024-02-21 96 英文报告下载

Economic activity declined slightly on average, employment was roughly flat...

2024-02-07 67 英文报告下载

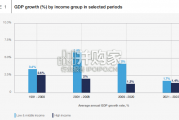

Economic growth can be defned as an increase in the quantity or quali...

2024-02-06 82 英文报告下载

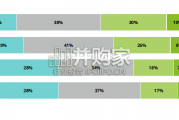

In this initial quarterly survey, 41% of leaders reported their organizatio...

2024-02-05 66 英文报告下载

最新留言