China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

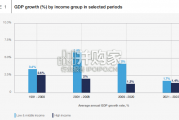

While the risks around the trade negotiations remain significant – on 12 November, President Trump noted that tariffs would be “raised very substantially” if no agreement is reached – the incentives for the US to seal a deal are clear. In the past 100 years, only four sitting Presidents have failed to gain a second term (Bush ‘92, Carter ‘80, Ford ‘76, Hoover ‘32), with a weak economy instrumental on each of those occasions. If a trade deal is indeed struck, we feel that a growth inflection point will soon follow, with the current cycle likely to bottom out in Q4 at a similar pace as seen in the previous two “slowdown scares”. What will drive the recovery? In part, our forecast is informed by the experience early this year, when the impact of the September 2018 tariffs proved transitory.

While the September 2018 tariffs had a large negative impact on trade and industrial production in 2018Q4, industrial production began to grow again by February 2019 (five months later). Similarly, GDP growth in 2019H1 (2¾% saar) was modestly stronger than that seen in 2018H2 (2¼% saar). Growth continued to rebound until new tariffs were applied in May. We expect this process to be repeated this year. The May tariffs saw industrial production growth slow in Q3, with the September tariff increase likely to weigh on trade and industrial production in Q4. But absent another tariff increase, we suspect the hit to growth will begin to fade in Q1. Note that while the much-watched manufacturing PMIs have begun to show signs of a turning point, in large part this looks to be due to the fact that these surveys reflect companies’ estimates of y/y changes in production (the way corporates and equity analysts think about data), rather than monthly, seasonally adjusted changes (the way economists like to think). We expect the hard m/m growth numbers in Q4 to be weak as the September tariffs weigh. For example, the increase in Chinese industrial production in the month of October was 0.17% – the second weakest outturn since this series was first published – while US IP growth came in at -0.8%. But the surveys may surprise to the upside given that the y/y comparison is dropping out very weak numbers from last year (-0.4% in November and - 0.1% in December)pan.

The expected rebound will also be supported by policy stimulus. US monetary conditions have eased dramatically over the past 12 months – at this time last year, the Fed was still increasing rates, but this year it is easing, with the fed funds rate down 75 basis points in recent months. Significantly, long-term rates have fallen dramatically, with the US 30-year mortgage rate falling by 150 basis points from its late 2018 peak. Other central banks have joined the easing cycle, with most cutting rates in recent months. While Chinese stimulus has been limited so far, we expect policy makers to step up efforts to stabilise the economy early next year as GDP growth dips below 6%.

标签: 英文报告下载

相关文章

China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

Though the risk of AI leading to catastrophe or human extinction had...

2024-02-26 52 英文报告下载

Focusing on the prospects for 2024, global growth is likely to come i...

2024-02-21 96 英文报告下载

Economic activity declined slightly on average, employment was roughly flat...

2024-02-07 67 英文报告下载

Economic growth can be defned as an increase in the quantity or quali...

2024-02-06 82 英文报告下载

In this initial quarterly survey, 41% of leaders reported their organizatio...

2024-02-05 66 英文报告下载

最新留言