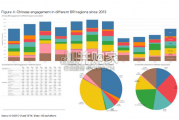

China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

Financial conditions. Since the Great Financial Crisis (GFC),academics have studied the link between financial conditions and economic activity (see Hatzius et al.2010),and central bankers have taken financial conditions as an input into their reaction function. If financial conditions tighten too much, then economic activity will slow,encouraging central banks to counter by easing monetary policy. And vice versa. As such, financial conditions play an important role for investors trying to predict a central bank's next move. At present, financial conditions are as loose as they were going into the GFC (see Exhibit 1). This suggests that real demand should increase and put upward pressure on prices,all else equal - bringing central banks closer to inflation mandates,allowing a withdrawal of monetary policy accommodation. Indeed, our economists project monetary policy tightening from G10 and EM central banks in 2022 on the back of robust growth and mandate-consistent inflation. In 2023, EM central banks begin to ease while G10 central banks tighten policy further (see Exhibit 2). Still, policy tightening will fall far short of levels reached in 2018.

When financial conditions tighten abruptly – as in 2008/2009,2011,and 2020 – central banks react by easing policy aggressively. Investors who understand this framework might expect the most aggressive central bank easing seen in the modern era to result from the fastest tightening of financial conditions in the modern era, like what we saw in March 2020 (see Exhibit 3). An alternative financial conditions framework So, we know how investors can use financial conditions to predict central bank policy action. And many investment strategies look to benefit from moves in market-implied policy rates or other bond yields that might be affected by unconventional policies, like quantitative easing. But, for many investors, investing is about more than predictinghow central bank policies will respond to rapidly changing financial conditions. Indeed, in developed markets, financial conditions don'tusually move in ways that catalyze abrupt changes in monetary policy. As a result, many investment strategies look to benefit from more normal movements in financial conditions themselves.

标签: 英文报告下载

相关文章

China’s financing and investment spread across 61 BRI countries in 2023 (up...

2024-02-27 31 英文报告下载

Though the risk of AI leading to catastrophe or human extinction had...

2024-02-26 51 英文报告下载

Focusing on the prospects for 2024, global growth is likely to come i...

2024-02-21 96 英文报告下载

Economic activity declined slightly on average, employment was roughly flat...

2024-02-07 67 英文报告下载

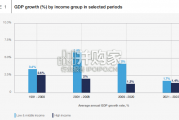

Economic growth can be defned as an increase in the quantity or quali...

2024-02-06 82 英文报告下载

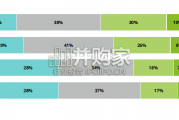

In this initial quarterly survey, 41% of leaders reported their organizatio...

2024-02-05 66 英文报告下载

最新留言